when going down or sideways, follow the guided step-by-step strategy in advance.

we help you learn how to generate additional income.

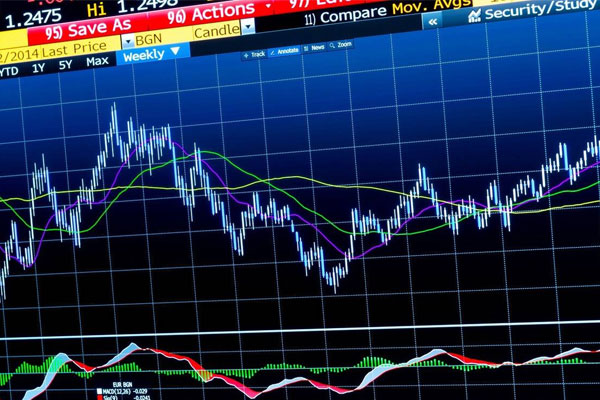

| Station last week 20MA | Breaking below 20MA weekly | |

|---|---|---|

| tend to be | several trends | short side trend |

| practice | do more | short |

| average time | 20 weeks equal average | 20-week moving average |

| When the stock price rises | If the stock price goes down | |

|---|---|---|

| great deal | multiple trends | bearish trend |

| low volume | multifaceted uptrend | downtrend |

Short-term follower

Short-term follower

Digging lovers

Digging lovers

Steady investor

Steady investor

Confused loser

Confused loser

Pre-market public stock

poolOpen the stock pool at 9 o'cock ervery day before the market,

whether it is bullish

or not, chock the roal olfor to see the effect!

Pre-market public stock

poolOpen the stock pool at 9 o'cock ervery day before the market,

whether it is bullish

or not, chock the roal olfor to see the effect!

Stock picking skills, catching bull

tacticsOnline teaching by a team cf famous teachers. combined with actual stock

trading cases, assists investors in making individual stock dedisions fron

mulalo dmensiors o captal,rends.and voiume.

Stock picking skills, catching bull

tacticsOnline teaching by a team cf famous teachers. combined with actual stock

trading cases, assists investors in making individual stock dedisions fron

mulalo dmensiors o captal,rends.and voiume.

Interpret the market, study and judge the

general trendEveryone interprets market trends and industry

researchreports in real time. Grasp the market vane.

Interpret the market, study and judge the

general trendEveryone interprets market trends and industry

researchreports in real time. Grasp the market vane.

The instructor will present a strong stock to everyone daily, with an expected increase of 10-20%!

The instructor will present a strong stock to everyone daily, with an expected increase of 10-20%!

The instructor will analyze the market daily, enabling every member of the group to profit easily!

The instructor will analyze the market daily, enabling every member of the group to profit easily!

February, we will start three months of free online teaching!

February, we will start three months of free online teaching!